Click to download now, finish the installation quickly, and directly unlock the "all-round experience"

About This App

🏆 Expert Verdict & Overview

Afterpay: Pay over time represents a pivotal shift in modern consumer finance, positioning itself as a dominant force in the "Buy Now, Pay Later" (BNPL) sector within the global Shopping landscape. By seamlessly bridging the gap between immediate gratification and financial management, the app provides a structured, transparent alternative to traditional credit cards. Its authoritative presence is backed by a massive merchant network and a user-centric model that prioritizes interest-free short-term financing, making it a benchmark for utility and reliability in the fintech space.

🔍 Key Features Breakdown

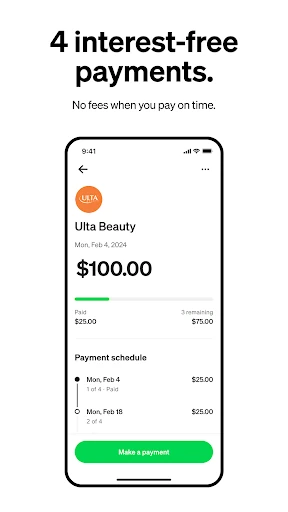

- Pay in 4 Installments: This flagship feature allows users to split purchases into four interest-free payments over six weeks, effectively lowering the barrier to entry for essential purchases without the burden of traditional high-interest debt.

- Flexible Monthly Financing: For high-ticket items, Afterpay offers extended terms ranging from 3 to 24 months, providing a tailored solution for major investments like electronics and home goods.

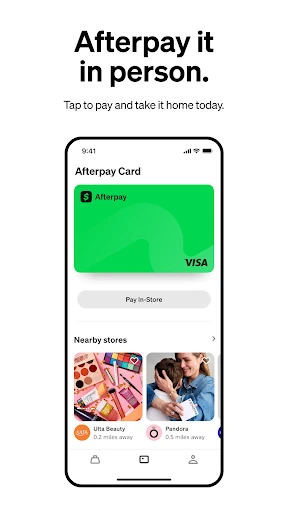

- Contactless In-Store Payments: The "Tap to Pay" functionality extends digital convenience to brick-and-mortar retailers, allowing users to take products home immediately while maintaining their preferred payment schedule.

- Dynamic Spending Power: Users receive real-time feedback on their pre-approved spending limit, which encourages responsible financial behavior by rewarding on-time payments with increased purchasing power.

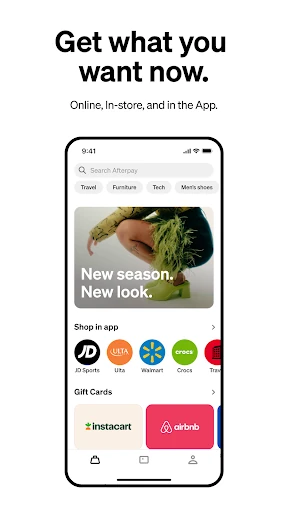

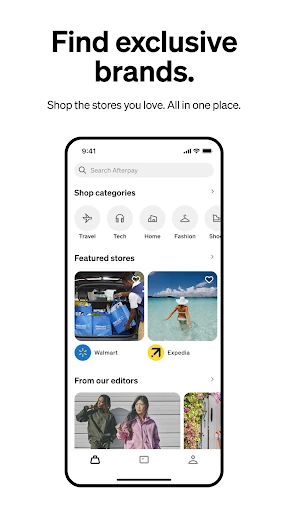

- Integrated Marketplace & Gift Cards: Beyond payments, the app serves as a discovery engine with curated brand round-ups and the ability to purchase and split-pay for gift cards from hundreds of top-tier retailers.

🎨 User Experience & Design

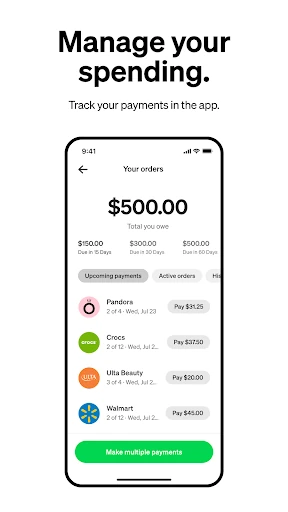

The UI of Afterpay is engineered for transactional fluidity and clarity. It features a clean, high-contrast interface that prioritizes the "Spend Limit" visibility on the dashboard, ensuring users are always aware of their financial boundaries. The navigation is intuitive, utilizing a logical bottom-bar layout that separates brand discovery, shop-in-store features, and account management. From a UX perspective, the checkout process is remarkably frictionless, successfully reducing the cognitive load often associated with financial transactions. The inclusion of editorially curated guides adds a lifestyle layer that transforms the app from a mere payment utility into a comprehensive shopping destination.

⚖️ Pros & Cons Analysis

- ✅ The Good: Transparent "Pay in 4" model with zero interest and no fees when payments are made on time.

- ✅ The Good: Massive merchant ecosystem covering fashion, tech, beauty, and travel, accessible both online and in-store.

- ❌ The Bad: Late fees can accumulate quickly if the user lacks a disciplined repayment strategy, potentially impacting future spending limits.

- ❌ The Bad: Monthly payment plans are subject to credit checks and may carry high APRs depending on the user's eligibility and the specific merchant.

🛠️ Room for Improvement

While Afterpay excels in transaction management, the app could benefit from more robust integrated budgeting tools that analyze total spending across different categories to help users visualize their financial health. Additionally, enhancing the search functionality with more granular filters—such as the ability to filter specifically for merchants offering 0% APR on long-term monthly plans—would provide greater transparency and value for cost-conscious shoppers. Integration with third-party loyalty programs could also further incentivize long-term user retention.

🏁 Final Conclusion & Recommendation

Afterpay: Pay over time is an essential tool for the modern, digitally-native shopper who seeks financial flexibility without the revolving debt traps of traditional credit. It is particularly well-suited for Gen Z and Millennial consumers who prefer structured, predictable payment schedules. For any shopper looking to manage cash flow while accessing premium brands, Afterpay remains a top-tier recommendation and a gold standard in the BNPL category.