Click to download now, finish the installation quickly, and directly unlock the "all-round experience"

About This App

🏆 Expert Verdict & Overview

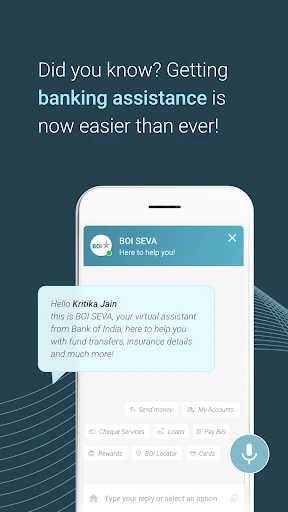

BOI Mobile stands as the definitive digital gateway for Bank of India customers, positioning itself as a cornerstone in the competitive Indian retail finance landscape. As a legacy institution's primary mobile touchpoint, the app successfully bridges the gap between traditional branch-based banking and the modern demand for "banking on the go." It is designed to be a comprehensive financial hub, consolidating diverse account types—from standard savings to complex loan portfolios—into a singular, secure interface. In an era where fintech agility is paramount, BOI Mobile provides the necessary utility and security protocols required to maintain user trust while facilitating high-frequency transactions.

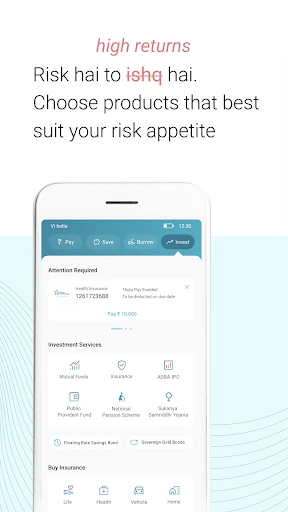

🔍 Key Features Breakdown

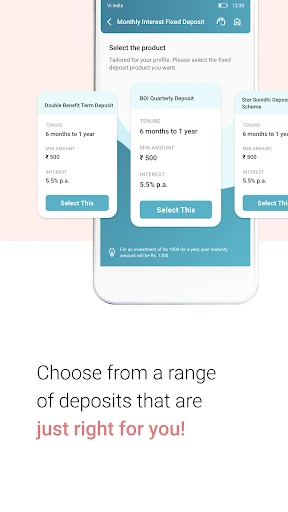

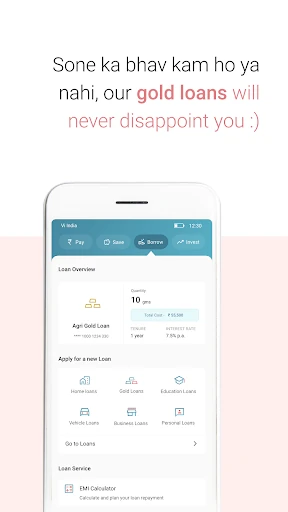

- Unified Account Management: Allows users to monitor and transact across savings, loans, and deposit accounts, providing a holistic view of their financial health without needing multiple logins.

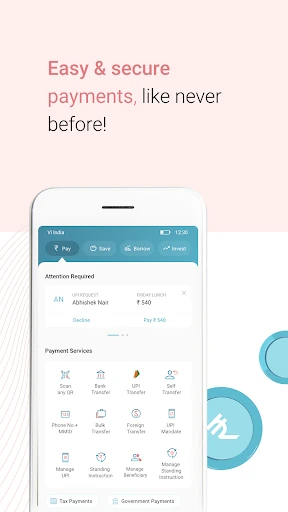

- Multi-Protocol Fund Transfers: Integration of IMPS, NEFT, RTGS, and UPI ensures that users have maximum flexibility for both micro-payments and high-value transfers at any time.

- Digital Passbook & Statements: Eliminates the need for physical branch visits by offering detailed transaction histories and emailable statements, catering to the needs of modern record-keeping.

- "Favourite" Transaction Tagging: Solves the friction of repetitive data entry by allowing users to save frequent beneficiaries for one-tap future payments, significantly enhancing transactional speed.

- Remote Service Requests: Empowers users to manage cheque books, track service requests, and locate ATMs from their device, effectively turning the smartphone into a personal bank branch.

🎨 User Experience & Design

The UI of BOI Mobile adheres to the functional and utilitarian standards expected of a major public sector bank. While it prioritizes security and clarity over avant-garde aesthetics, the interface is structured logically to ensure that even non-technical users can navigate the core banking features. The UX focuses on reducing the "time-to-task" for critical actions like balance checks and fund transfers. However, compared to modern neo-banking apps, the design remains conservative, favoring a stable and predictable layout that ensures reliability across a wide range of Android hardware.

⚖️ Pros & Cons Analysis

- ✅ The Good: Robust security framework that ensures safe transactions across all banking channels.

- ✅ The Good: Comprehensive feature set that covers almost every service traditionally requiring a branch visit.

- ❌ The Bad: The initial registration and device binding process can be cumbersome for users with unstable network connections.

- ❌ The Bad: The visual density of the menu system can feel overwhelming compared to more minimalist financial applications.

🛠️ Room for Improvement

To further elevate the user experience, BOI Mobile should consider implementing a more streamlined, biometric-first login flow to reduce friction. Additionally, integrating advanced spending analytics or AI-driven financial insights could help users better manage their budgets. A visual overhaul focusing on white space and modern iconography would also bring the app in line with contemporary UI trends, making the vast array of features feel more accessible and less cluttered.

🏁 Final Conclusion & Recommendation

BOI Mobile is an essential tool specifically tailored for Bank of India account holders who require a dependable and feature-rich banking environment. It is best suited for users who value functional depth and official security over experimental design. For the everyday customer, this app is a powerful utility that successfully digitizes the traditional banking experience, making it a highly recommended installation for anyone looking to manage their BOI accounts with efficiency and peace of mind.