Click to download now, finish the installation quickly, and directly unlock the "all-round experience"

About This App

🏆 Expert Verdict & Overview

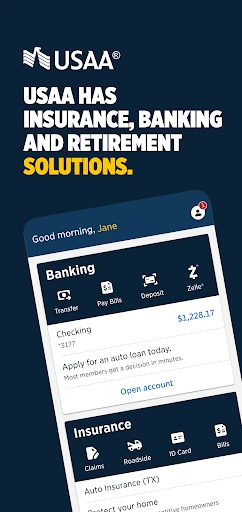

USAA Mobile serves as a benchmark for integrated financial services, specifically engineered for the unique lifestyle requirements of military members, veterans, and their families. Within the competitive Finance landscape, it distinguishes itself not just as a banking tool, but as a comprehensive management hub that converges banking, insurance, and investment services into a single, high-security ecosystem. It effectively balances institutional reliability with modern mobile conveniences, making it an essential utility for its specific demographic.

🔍 Key Features Breakdown

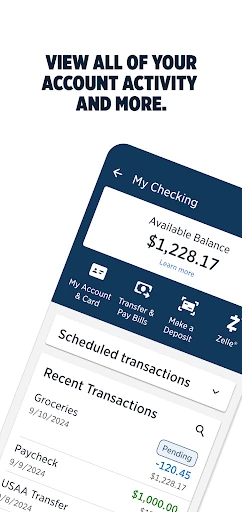

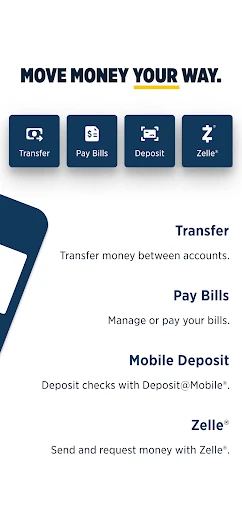

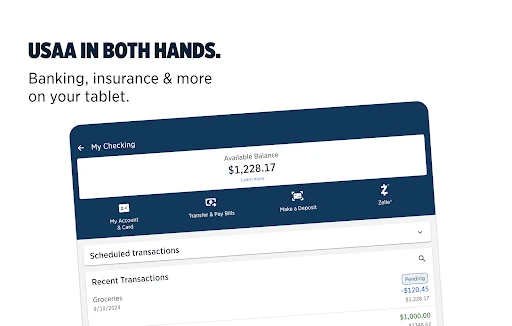

- Full-Service Banking Suite: Solves liquidity and payment friction by integrating Zelle for peer-to-peer transfers, remote check deposits, and a comprehensive bill-pay system.

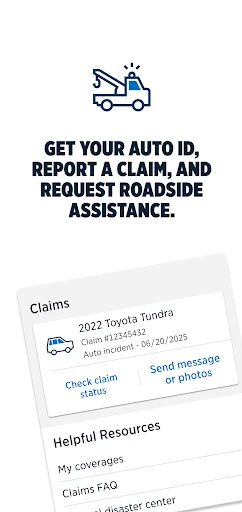

- Integrated Insurance Management: Eliminates the stress of paperwork during emergencies by providing instant digital ID cards and direct-access roadside assistance or claim reporting.

- Biometric Security Protocols: Addresses the need for high-level data protection while maintaining quick access through the use of device biometrics and secure PINs.

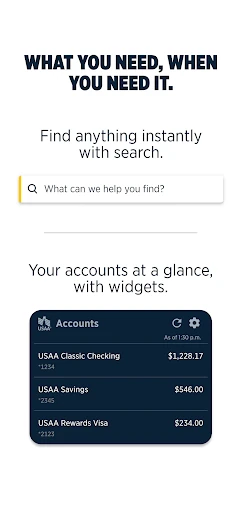

- Intelligent Search & Chat: Reduces the complexity of navigating a multi-faceted app by using smart search tools to help users find specific documents or services quickly.

- Glanceable Widgets: Enhances user awareness by allowing transaction history and balance monitoring directly from the home screen without requiring a full app launch.

🎨 User Experience & Design

The UI/UX design of USAA Mobile reflects a "utility-first" philosophy common in high-tier financial applications. The interface is clean and professional, prioritizing readability and logical grouping of disparate services like insurance and banking. While the vast number of features could easily lead to a cluttered experience, the implementation of smart search and customizable widgets helps maintain a streamlined workflow. The design successfully conveys a sense of security and institutional trust, which is critical for users managing military-related financial assets.

⚖️ Pros & Cons Analysis

- ✅ The Good: A true "all-in-one" platform that eliminates the need for separate apps for banking, auto insurance, and home insurance.

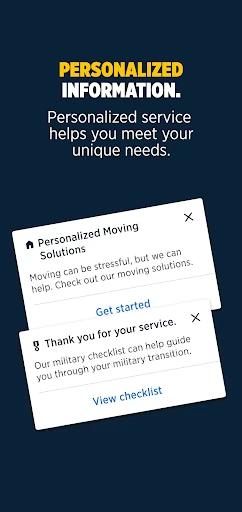

- ✅ The Good: Exceptional focus on the specific needs of the military community, such as easy access to deployment-relevant insurance tools.

- ❌ The Bad: The depth of the app can lead to a steep learning curve for users who only require basic banking functions.

- ❌ The Bad: Heavy reliance on a stable connection for biometric sync and real-time insurance updates, which may be a hurdle in low-connectivity environments.

🛠️ Room for Improvement

To further elevate the user experience, the developers could implement more proactive financial health insights using the existing "Smart Search" AI to suggest budgeting tips based on transaction history. Additionally, refining the navigation to allow for more user-defined shortcuts on the primary dashboard would reduce the number of taps required to access deeply nested insurance features.

🏁 Final Conclusion & Recommendation

USAA Mobile is the definitive financial companion for USAA members, specifically active-duty service members and veterans who require consolidated management of their financial lives. It is highly recommended for users who want a secure, feature-rich environment that respects the nuances of military life. While it may be overly complex for those seeking a simple checking account, its value as a holistic financial tool is unmatched in its category.